Money should bring peace of mind, not stress.

We help you shift from worry to confidence, guiding you step by step and replacing uncertainty with a clear, achievable roadmap for success. As a result, you can move forward with a sense of clarity, knowing exactly what actions to take. Whether you’re facing financial challenges or seeking to improve your future, our approach empowers you to take control and confidently navigate each decision.

Confident decisions

Tailored strategies

Clear goals

Why team up with us?

We’re redefining financial advice with a unique, GUARANTEE.

Offer is: IF you become a client – we will save you more money than any initial fee. Or put another way, we guarantee that if you use our service, we will put more money in your pocket than you give to us.

A uniquely personal approach

Your life isn’t one-size-fits-all, and your financial strategy shouldn’t be either. We take the time to truly understand you, aligning your financial plan with what matters most—your goals, values, and vision for the future.

Money is a tool, not the goal

We don’t just focus on numbers—we focus on you. Financial planning isn’t about hoarding wealth; it’s about making choices that allow you to live fully, now and in the future.

No commissions, no hidden agendas

We work for you—not for banks or product providers. With no commissions or kickbacks, our advice is always in your best interest.

Smart strategies that build wealth

Let’s be real—you’re here to make money. Our diverse expertise, forward-thinking strategies, and deep market knowledge ensure your wealth is working for you.

We simplify the complex

Financial jargon? No thanks. We believe in clarity and simplicity, so you feel informed, confident, and in control of your financial future.

Book your free consultation now!

Ready to take the next step? Take action now and book your free consultation today.

Our unique GUARANTEE – We guarantee that if you become a client, we will save your more than any initial fee. With expert guidance, we’ll find a range of ways that mean you keep more money in your pocket from day 1. The beauty of this is that this saving will grow further over time.

By starting your journey here, you’ll get the chance to find out whether your situation can allow us the various tools and tricks to gain you, $3,000, $6,000 or much more (sometimes).

And the best part, all the risk is on us as the first consult is FREE…

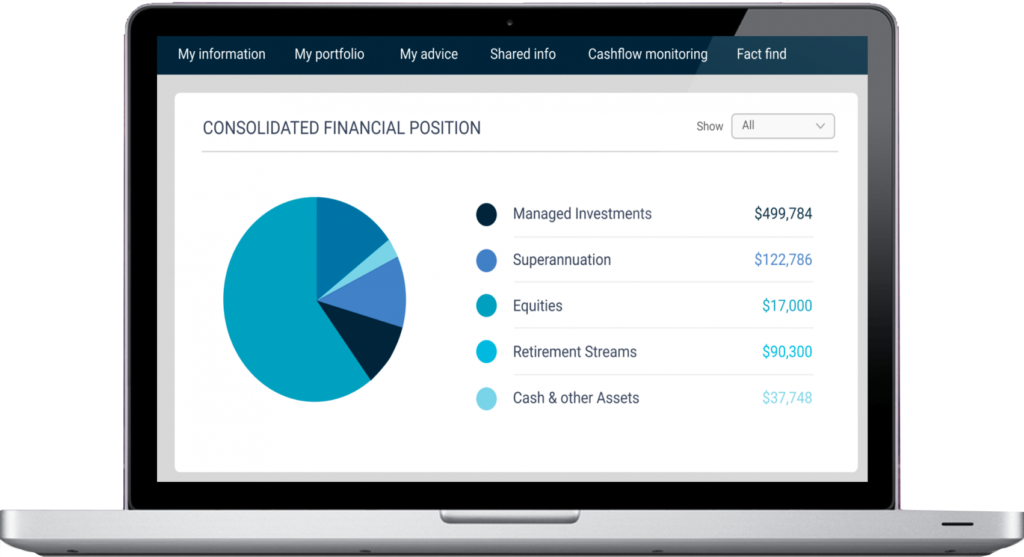

We use the cutting-edge PlatformPlus platform to offer you an intuitive, personalised client portal designed to enhance your financial planning experience. With this powerful platform, you can easily track your investments, view your financial plan, and monitor progress toward your goals—all in real-time. The portal gives you secure access to your portfolio, reports, and documents, allowing you to stay informed and make confident decisions.

Through PlatformPlus, you can communicate directly with our team, schedule consultations, and receive tailored advice based on your specific needs. This seamless integration of technology into our services means you can focus on your financial goals while we provide the expertise and insights you need to achieve them.

Superannuation calculator

This calculator helps you work out:

how much super you’ll have when you retire, how fees affect your final super balance

Super contribution

optimiser

Helps you work out:

which type of super contribution will give your super the biggest boost,

how to make super contributions

Simple money manager

Helps you work out: your income and expenses

has audio content to explain each category

Managed funds

fee calculator

This calculator helps you check:

how fees and costs affect your investment the impact of fees and costs between different funds

Employer contributions calc

Use this calculator to:

work out how much super you should be getting from your employer

check if you are getting the right amount per month

Savings goals calculator

This calculator helps you work out:

how long it will take to reach your savings goals

steps to take to put your plan into action